- CALCULATING DISCOUNTED CASH FLOW FULL

- CALCULATING DISCOUNTED CASH FLOW PLUS

- CALCULATING DISCOUNTED CASH FLOW FREE

In this calculation we've used 8.1%, which is based on a levered beta of 1.000. Given that we are looking at Palantir Technologies as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt.

CALCULATING DISCOUNTED CASH FLOW FULL

The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance.

Part of investing is coming up with your own evaluation of a company's future performance, so try the calculation yourself and check your own assumptions. Now the most important inputs to a discounted cash flow are the discount rate, and of course, the actual cash flows. Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out. Relative to the current share price of US$15.0, the company appears quite good value at a 49% discount to where the stock price trades currently. In the final step we divide the equity value by the number of shares outstanding.

CALCULATING DISCOUNTED CASH FLOW PLUS

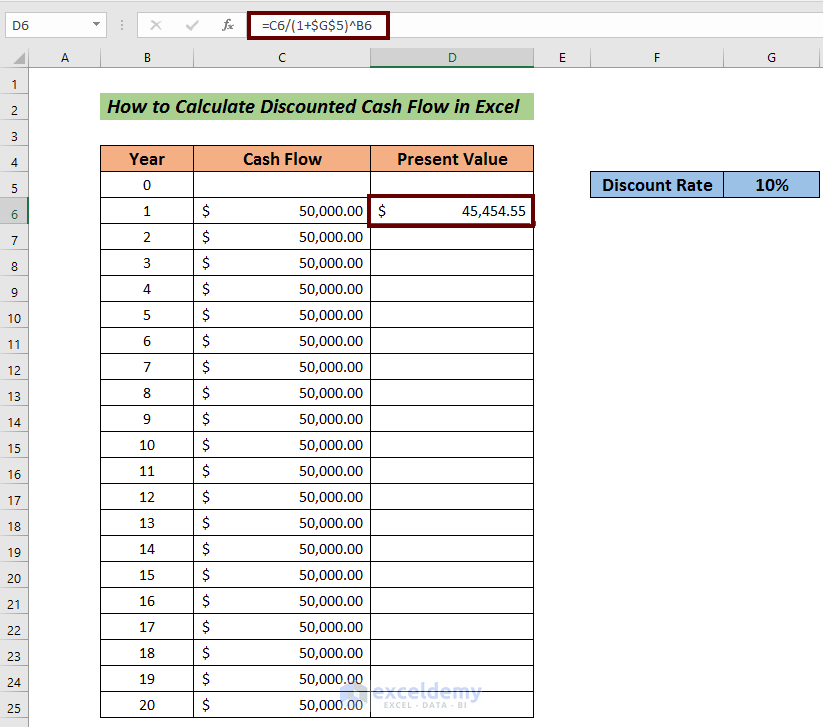

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$63b. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 8.1%. In this case we have used the 5-year average of the 10-year government bond yield (2.1%) to estimate future growth. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. We do this to reflect that growth tends to slow more in the early years than it does in later years.Ī DCF is all about the idea that a dollar in the future is less valuable than a dollar today, and so the sum of these future cash flows is then discounted to today's value:Īfter calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage.

CALCULATING DISCOUNTED CASH FLOW FREE

We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period.

.png)

Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. In the first stage we need to estimate the cash flows to the business over the next ten years. The first stage is generally a higher growth period which levels off heading towards the terminal value, captured in the second 'steady growth' period. We are going to use a two-stage DCF model, which, as the name states, takes into account two stages of growth. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.Ĭheck out our latest analysis for Palantir Technologies The Model Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. Believe it or not, it's not too difficult to follow, as you'll see from our example! This will be done using the Discounted Cash Flow (DCF) model. ( NYSE:PLTR) by taking the forecast future cash flows of the company and discounting them back to today's value. Today we will run through one way of estimating the intrinsic value of Palantir Technologies Inc. Our fair value estimate is 211% higher than Palantir Technologies' analyst price target of US$9.54 Palantir Technologies' US$15.02 share price signals that it might be 49% undervalued The projected fair value for Palantir Technologies is US$29.65 based on 2 Stage Free Cash Flow to Equity

0 kommentar(er)

0 kommentar(er)